Business

Uganda Overtakes Tanzania in GDP Per Capita

This information comes from the International Monetary Fund’s (IMF) projections for 2025.

In a significant shift within East Africa’s economic landscape, Uganda has surpassed Tanzania to become the second-richest country in the region by GDP per capita, following Kenya. This information comes from the International Monetary Fund’s (IMF) projections for 2025. According to the IMF’s October 2024 World Economic Outlook (WEO), Uganda’s GDP per capita is estimated at $1,300, narrowly exceeding Tanzania’s $1,270, while Kenya leads the region with a GDP per capita of $2,190. Rwanda, often referred to as the “Singapore of Africa” due to its aggressive development model, has a GDP per capita of approximately $990 to $1,022. This development is a significant moment for Uganda, highlighting years of economic progress and strategic investments, even as broader regional dynamics and global economic conditions influence these results.

GDP per capita, calculated by dividing a country’s total economic output (GDP) by its population, provides insight into average economic well-being. The IMF’s 2025 projections indicate:

- Kenya: $2,190 – Solidifying its status as East Africa’s economic powerhouse.

- Uganda: $1,300 – A notable advance, overtaking Tanzania by a slim margin.

- Tanzania: $1,270 – A slight decline relative to Uganda, despite having a larger overall economy.

- Rwanda: Approximately $990 to $1,022 – Experiencing steady but slower growth compared to its neighbors.

These figures contrast with 2023 data from the World Bank, where Kenya stood at $1,952.3, Tanzania at $1,224.5, and Uganda at $1,002.3. The IMF’s forward-looking estimates suggest that Uganda’s per capita income has grown significantly, driven by a projected real GDP growth rate of 6.0% in 2024 and 7.0% in 2025, outpacing Tanzania’s expected 5.4% and 6.0% growth for the same period.

Uganda’s economic rise can be attributed to a combination of structural reforms, growth in various sectors, and strategic investments particularly in its emerging oil sector. Here are the key drivers:

- Oil and Gas Boom: Uganda’s oil sector is approaching commercial production, with projects like the East African Crude Oil Pipeline (EACOP) and the Tilenga and Kingfisher fields poised to enhance revenues. While actual production is expected to begin around 2025-2027, preparatory investments have already spurred economic activity, attracting foreign direct investment (FDI) and stimulating related sectors such as construction and logistics.

- Diversified Growth: Beyond oil, Uganda has shown strong performance in mining, construction, and hospitality. The African Development Bank reported a 4.6% GDP growth in 2023, decreasing from 6.3% in 2022, but projections for 2024 and 2025 suggest a rebound driven by consumer demand and regional trade. Although agriculture still employs 70% of the workforce, higher productivity sectors like services and manufacturing are emerging.

- Population Dynamics: With a population of approximately 49 million, Uganda’s economic gains are translating more effectively into per capita terms compared to Tanzania’s larger population of 65 million. This balance allows Uganda’s GDP growth to have a more direct impact on individual income levels.

Tanzania has experienced steady but relatively slower per capita growth compared to its neighbors. In 2023, the country’s economy grew by 5.2% and is projected to grow by 5.4% in 2024 and 6.0% in 2025, according to the IMF. Key drivers of Tanzania’s economy include agriculture, manufacturing, and tourism, along with public investments and business-friendly reforms under President Samia Suluhu Hassan. However, Tanzania’s larger population dilutes its per capita figures. Its total GDP ($79.06 billion in 2023) significantly exceeds that of Uganda ($48.77 billion), highlighting the distinction between overall wealth and per capita metrics.

Kenya maintains its leading position due to its diversified and industrialized economy, which encompasses sectors such as finance, technology (e.g., M-Pesa), and agriculture, with a projected GDP growth rate of 5.0% to 5.5% for 2025. Meanwhile, Rwanda, despite its effective governance and urban development, faces challenges due to its smaller economic base. Its GDP per capita is increasing but still lags behind its regional counterparts due to reliance on tourism and agriculture.

Uganda’s economic ascent is not without challenges. The country’s public debt-to-GDP ratio rose to 49.6% in 2023, which is considered sustainable but indicates a need for fiscal discipline as oil revenues begin to ramp up. Additionally, poverty has increased, from 21.4% in 2017 to 30.1% in 2020, highlighting that per capita gains have not yet reached all segments of the population. Tanzania is currently facing tight financing conditions and exchange rate pressures, although its inflation remains low at 3.0%-4.0%. Kenya is grappling with debt servicing costs, while Rwanda’s high growth, projected at 7%-8%, is moderated by its smaller economic base.

Globally, the IMF forecasts a 3.2% growth rate for 2025, with Sub-Saharan Africa projected to grow at 4.0%-4.2%, suggesting that East Africa remains a bright spot. If Uganda manages its oil-driven trajectory effectively, it could solidify its position in the region. Still, Tanzania’s larger economy and Kenya’s regional dominance ensure a competitive landscape.

While the claim about which country is the “richest” hinges on GDP per capita, this perspective is somewhat narrow. Total GDP reflects a country’s economic size, in which Tanzania and Kenya outpace Uganda. Using purchasing power parity (PPP) or assessing wealth distribution might yield different rankings. Nonetheless, Uganda’s emerging status underscores its potential as a rising player in the region, reshaping narratives once dominated by Kenya and, to a lesser extent, Tanzania.

Business

The Meta Trap: How One Bot Strike Can Liquidate Your Digital Career

As a digital communicator, this ban doesn’t just erase a social profile; it obliterates gigs and revenue streams.

In the fast-paced world of digital communications and marketing, your online presence is your livelihood. For me, it was the foundation of multiple businesses: a music artist page, a clothing brand, a design company, and numerous client accounts. But on December 9th, everything changed with a single email from Meta. What started as a routine suspension notice escalated into a permanent ban overnight, stripping me of access to my entire professional ecosystem. No explanation. No recourse. Just gone. This isn’t just my story, it’s a cautionary tale for anyone relying on Meta’s platforms for their career.

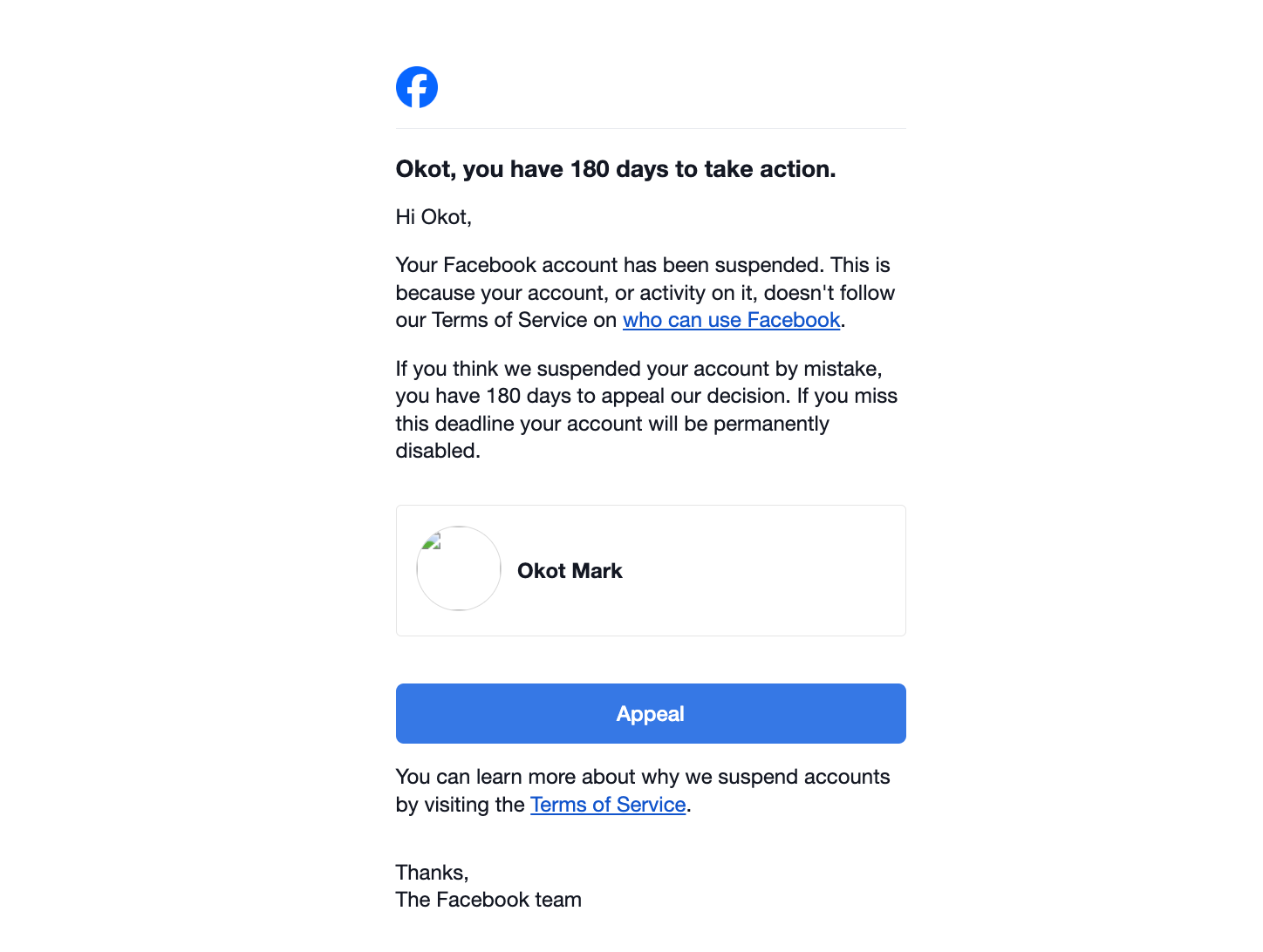

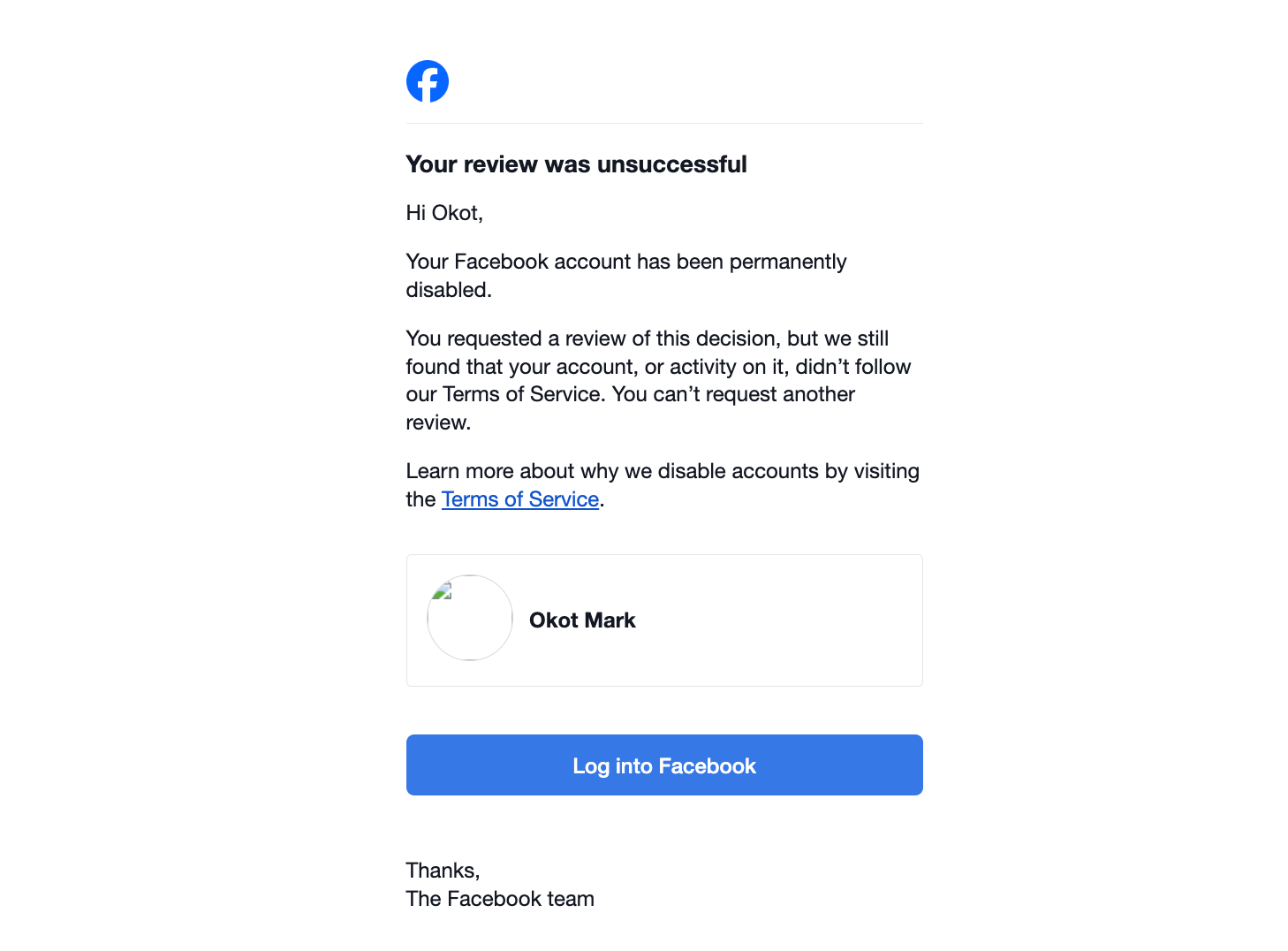

I arrived home that evening to find an email from Meta notifying me that my Facebook account had been suspended. It urged me to appeal within 180 days, or face permanent deletion. Puzzled but proactive, I submitted my appeal immediately. By the next morning, another email arrived: my account was permanently disabled, and the appeal had been denied. No reasons were provided, just a cold statement that I’d lost access forever.

I rarely posted personal content on Facebook. My account was primarily a gateway to Meta Business Suite, the hub for managing professional pages across Facebook and Instagram. Through it, I controlled a suite of business assets: my own ventures and those of my clients. As the sole full admin, I handled everything from content scheduling to campaigns. Little did I know, this setup was a ticking time bomb.

When you create a page on Facebook or Instagram, linking them via Meta Business Suite creates a unified Business Portfolio. This is the command center for your digital empire. It allows you to manage pages, grant roles to team members, and integrate tools like WhatsApp Business Platform for large-scale operations. Third-party services often require access to this portfolio to function properly.

The problem? Meta’s system ties these portfolios tightly to personal accounts. When my account was banned, I was automatically removed as the full admin, leaving the role vacant. Suddenly, Meta held sole control over my pages and client portfolios. Attempts to log in via Instagram offered limited access, but I couldn’t remove the banned account or promote another user to full control.

Desperate for resolution, I reached out to Meta’s support; only to discover it’s virtually nonexistent for issues like this. Human responses (when they came) were unhelpful. Many online forums suggested subscribing to Meta Verified on Instagram as a workaround, but that didn’t resolve the core issue. I even filed countless “Admin Dispute Claims,” providing every requested document: business registrations, IDs, proof of ownership. Their response? They couldn’t manually promote another admin because the original account was banned. The exact reason I was disputing in the first place!

This circular logic is infuriating. Online communities are rife with similar complaints: Meta’s automated bots flag and delete accounts without transparency or appeal processes that actually work. Some advise assembling a legal team to confront Meta directly, arguing that they’re effectively holding your digital assets hostage. In my case, that’s exactly what happened. I lost control of my music page, clothing brand, design firm, and client accounts overnight, all without a single violation explained.

As a digital communicator, this ban doesn’t just erase a social profile; it obliterates gigs and revenue streams. Clients rely on seamless access to their ad data, analytics, and campaigns. Without it, projects stalled, trust eroded, and opportunities vanished. Researching further, I found this is a widespread epidemic. Countless marketers, creators, and small business owners have shared horror stories on forums like Reddit and X (formerly Twitter). Meta’s opaque algorithms and lack of accountability have led to lost livelihoods, with users begging for reasons that never come.

The stakes are high in an industry where platforms like Meta control the gates to billions of users. One unjust ban, and your life’s work evaporates. It’s not just about losing followers; it’s about Meta seizing ownership of your Business Portfolio and refusing to relinquish it.

If you’re in digital marketing or communications, don’t wait for the dreaded email. Here’s how to safeguard your assets:

- Distribute Admin Roles Wisely: Grant full admin rights in your Business Portfolio to a few trusted colleagues or partners. This creates redundancy, so a single ban doesn’t lock everyone out.

- Create Backups: Set up duplicate pages or alternative accounts as contingencies. Mirror key content and audiences where possible.

- Disassociate Personal and Business Accounts: Where feasible, unlink your personal Facebook account from business pages. Use dedicated business profiles to minimize risk.

- Diversify Platforms: Don’t put all your eggs in Meta’s basket. Build presence on alternatives like LinkedIn, TikTok, or X to mitigate total loss.

- Prepare for the Worst: Document everything, screenshots of access, business proofs and consider legal consultation early. It is said that Meta responds better to formal demands than support tickets.

Meta’s ecosystem is powerful, but it’s also precarious. One day, without warning, they could claim full ownership of your digital portfolio and refuse to give it back. My experience proves it. Don’t let it happen to you, act now to secure your future in this volatile online world.

Business

What Ugandan Artists on Bandcamp Need to Know

The US has introduced new tariffs following the expiration of the de minimis exemption, which previously allowed duty-free imports for shipments under $800

As a Ugandan artist on Bandcamp, you may have received a recent email regarding new US tariffs impacting global shipping. Announced on August 28, 2025, these changes affect the shipment of physical merchandise from Uganda to the United States, an important market for independent artists. This guide explains what the tariffs mean for you, how they may impact your sales, and steps you can take to continue reaching US fans.

The US has introduced new tariffs following the expiration of the de minimis exemption, which previously allowed duty-free imports for shipments under $800. This shift means many physical goods shipped from Uganda to the US now face import duties. Additionally, the uncertainty around these tariffs has led many global mail carriers to suspend deliveries to the US, creating challenges even for tariff-exempt items. Here’s how this affects you:

- Tariffs Hit Physical Merch, Not Digital Sales

Apparel and other goods like shirts, hoodies, hats, and totes are now subject to tariffs, which could increase costs for your US buyers. Digital sales; your MP3s, FLAC files, or streaming revenue are unaffected, offering a safe haven for part of your income. - Exemption for Music and Media

Good news: “informational media” like vinyl records, CDs, cassettes, books, and sheet music are exempt from these tariffs. However, many international carriers are halting all shipments to the US, even for exempt items, due to the tariff confusion. - Shipping Disruptions

With global carriers suspending US deliveries, even exempt items such as vinyl or CDs may not reach American fans at this time. These disruptions could delay orders, impact customer satisfaction, and affect your sales if not addressed proactively.

The US is a vital market for Ugandan artists on Bandcamp, where fans frequently purchase physical releases and merchandise. These tariffs and shipping suspensions may disrupt this important connection.

- Higher Costs for Fans

US buyers may face unexpected import duties on non-exempt items like apparel, making your merch less affordable. If you choose to cover these costs (via Delivered Duty Paid shipping), your profit margins could shrink. - Limited Local Options

Uganda’s manufacturing scene for high-quality vinyl or custom apparel is limited, meaning many artists rely on international suppliers or direct exports. Tariffs and shipping issues complicate this, potentially raising costs or delaying production. - Fan Trust at Risk

Unexpected fees or undelivered orders may cause confusion or dissatisfaction among US fans. Clear communication is essential to maintain audience loyalty, particularly in genres where Ugandan artists have established strong followings.

Bandcamp and industry insights offer several ways for Ugandan artists to navigate these changes:

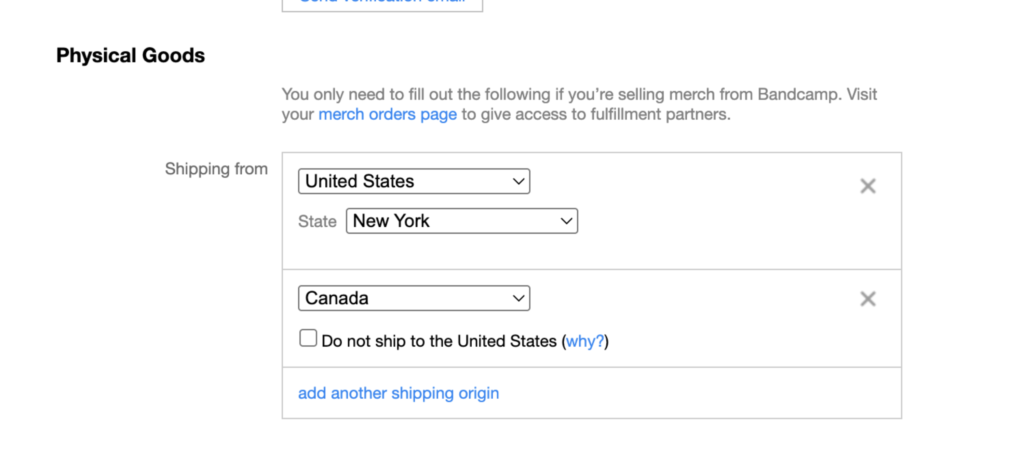

- Pause US Merch Sales (If Needed)

Bandcamp now lets you disable US shipping for physical goods from specific origins. Head to Edit Profile > Physical Goods > Shipping from in your account to temporarily pause sales. This can prevent headaches from undeliverable orders or unexpected fees while carriers sort out their US routes.

- Focus on Exempt Items

Prioritize selling tariff-exempt products like vinyl, CDs, or cassettes. Double-check with your postal carrier (e.g., Uganda Post or couriers like DHL) to see if they’re still shipping these to the US. Use accurate HS Codes on labels to ensure customs recognizes the exemption. - Talk to Your Fans

Use Bandcamp’s Community messaging feature to update US buyers about potential delays or tariff costs. Explain that these are government-imposed fees, not your doing, to keep fans supportive. A quick message can go a long way in preserving trust. - Consider Delivered Duty Paid (DDP) Shipping

For non-exempt items like apparel, DDP shipping lets you prepay tariffs and include them in the price, giving US fans cost certainty. This requires upfront calculations and may cut into profits, so weigh the pros and cons. - Lean into Digital Sales

Digital releases are tariff-free and immune to shipping woes. Promote your albums, singles, or virtual events to US fans to maintain revenue. For inspiration, look at how Ugandan artists like those on The Ugandan Rite use digital releases to reach global audiences. - Stay Updated

Check Bandcamp’s Help Center (https://get.bandcamp.help) for the latest on tariffs and shipping. Reach out to your postal carrier for updates on when US deliveries might resume. If you’re dealing with complex orders, consider consulting a trade expert for advice.

These tariffs and shipping disruptions could challenge Ugandan artists’ ability to reach US fans, a critical audience for Bandcamp sales. While digital sales offer a workaround, physical merch like vinyl or apparel is a big part of many artists’ income and cultural impact. In the long term, you might consider exploring regional markets in East Africa or pursuing digital collaborations to diversify your revenue, although these may not match the scale of the US market.

The new US tariffs are a hurdle, but Ugandan artists are no strangers to creativity and adaptability. By focusing on exempt items, pausing US shipping when needed, and keeping fans in the loop, you can minimize disruptions. Lean on Bandcamp’s tools and community to stay connected with your audience, and keep an eye on the Help Center for updates. Your music and merch are worth it; keep shining!

For more details, visit https://get.bandcamp.help or contact Bandcamp support.

Business

Uganda’s Kitgum-Kidepo Road Upgrade

Following the reintegration of the Uganda National Roads Authority (UNRA) into the MoWT in 2024, the ministry has taken full responsibility for delivering this vital project.

In a landmark decision, Uganda’s Parliament has authorized the government to secure a loan of €110.5 million (approximately Shs 450 billion) from Standard Chartered Bank. This funding will go towards upgrading the 115.8-kilometer Kitgum-Kidepo Road, a crucial infrastructure project that will connect the Kitgum and Kaabong districts in northern Uganda. The project aims to enhance tourism, improve regional connectivity, and address the socioeconomic challenges faced by the impoverished Karamoja subregion.

The Kitgum-Kidepo Road Project, led by the Ministry of Works and Transport (MoWT), involves rehabilitating an existing gravel road that extends from Kitgum town to the outskirts of Kidepo Valley National Park. Following the reintegration of the Uganda National Roads Authority (UNRA) into the MoWT in 2024, the ministry has taken full responsibility for delivering this vital project. The upgrade will transform the current Class C1 gravel road, which suffers from potholes, ruts, and poor drainage, into a high-quality, paved road. The project also includes widening the carriageway, improving drainage systems, and constructing two bridges to ensure year-round accessibility.

The road’s strategic location makes it crucial for unlocking agricultural productivity in Kitgum and Karenga districts, facilitating trade with South Sudan and Kenya, and promoting tourism by improving access to Kidepo Valley National Park, one of Uganda’s premier wildlife destinations.

On April 30, 2024, during a plenary session presided over by Speaker Anita Among, Hon. Henry Musasizi, the Minister of State for Finance, advocated for the loan’s approval. He emphasized the road’s importance in addressing the Karamoja subregion’s low road density, only 5.9 kilometers of paved roads per 1,000 square kilometers, and its potential to drive economic growth. “This road is critical for tourism and regional development,” he stated, pointing out that poor infrastructure has hindered Uganda’s ability to fully realize its tourism potential.

Despite broad support for the loan, the approval process faced scrutiny. Legislators, including the Leader of the Opposition, Hon. Joel Senyonyi, raised concerns about skipping a report from the House Committee on National Economy and the lack of transparency regarding the loan’s terms, such as interest rates and repayment schedules. Senyonyi warned about the risks of approving loans without thorough vetting, citing past problematic agreements. A motion by Government Chief Whip Hon. Denis Hamson Obua to waive the committee report requirement ultimately prevailed, reflecting Parliament’s commitment to addressing infrastructure deficits. The government has pledged that the loan will align with Uganda’s fiscal sustainability goals, with further details available through the Ministry of Finance.

An Environmental and Social Impact Assessment (ESIA) conducted in June 2024 ensures compliance with national and international standards, including the IFC’s Performance Standards and Equator Principles IV. The project will traverse open woodlands and semi-arid vegetation, avoiding critical habitats but will result in the loss of 14.4 hectares of natural habitat in the Nyangea-Napore Forest Reserve. Mitigation measures will address vegetation clearance, waste management, and dust emissions. The project will impact 59 culturally significant shea butter trees, which are valued for their spiritual, medicinal, and economic importance, as well as archaeological sites, including Iron Age pottery. Mitigation strategies include documentation, selective rerouting where feasible, and community consultations to preserve cultural heritage.

Socioeconomically, the project will benefit 158,549 individuals across the Kitgum and Karenga districts by improving access to markets, schools, and health facilities. Extensive stakeholder engagement, including focus groups with women, youth, and community leaders, has helped shape the project’s design. A grievance redress mechanism will ensure ongoing community feedback and conflict resolution. Challenges such as involuntary resettlement and gender-based violence will be mitigated through cash compensation, livelihood restoration initiatives, and community sensitization, with special attention given to vulnerable groups.

The upgraded Kitgum-Kidepo Road is poised to deliver transformative benefits, including:

- Tourism Boost: Improved access to Kidepo Valley National Park is expected to increase visitor numbers, supporting Uganda’s Vision 2040 goal of promoting tourism and potentially boosting regional tourism revenue.

- Economic Growth: Enhanced connectivity will facilitate domestic and cross-border trade, unlocking agricultural potential and creating hundreds of local jobs during construction, with further economic impact assessments underway.

- Social Impact: Year-round, safe passage will improve access to education, healthcare, and markets while reducing travel times. The upgrade will introduce speed bumps, signage, and pedestrian crossings to address current safety gaps, such as the low helmet usage (17%) among bodaboda cyclists and inadequate road markings.

- Environmental Benefits: A sealed road will reduce dust emissions, improving air quality and public health.

While the project holds immense promise, it faces challenges, including managing construction-related disruptions and ensuring equitable benefits. Mitigation measures include dust suppression, community sensitization on road safety, and adherence to a Resettlement Action Plan to support affected individuals. The road’s climate-resilient design, featuring elevated embankments, stormwater management, and a Climate Risk Monitoring Framework, will mitigate flood risks in a region with bimodal rainfall. The Ministry of Works and Transport (MoWT) will implement a robust monitoring framework to track environmental, social, and economic outcomes, with regular community feedback to ensure accountability.

The approval of the Kitgum-Kidepo Road upgrade marks a pivotal moment for Uganda’s northeastern region. By addressing infrastructure deficiencies, the project aligns with national development goals and sets the stage for economic and social transformation. As implementation progresses, stakeholders must ensure transparent execution and robust mitigation to maximize benefits for communities, businesses, and tourists. A map of the road’s route is available through the MoWT’s project documentation.

This historic investment in Uganda’s infrastructure underscores the government’s dedication to fostering inclusive growth and unlocking the potential of one of its most underserved regions. The Kitgum-Kidepo Road is not just a pathway; it is a gateway to a brighter future.

-

Entertainment1 year ago

Entertainment1 year agoMuseveni’s 2025 Copyright for Musicians breakdown

-

Business1 year ago

Business1 year agoUganda’s Ministry of Finance projects significant growth opportunities in 2025

-

Policies1 year ago

Policies1 year agoBreakdown of the Uganda Police Force Annual Crime Report 2024

-

Sports11 months ago

Sports11 months agoThe Transformative Impact of World Cup Qualification for Uganda

-

Policies1 year ago

Policies1 year agoIs Uganda’s Shs10m Fine the WORST Thing for Cohabiting Couples?

-

Business1 year ago

Business1 year agoThe 9 worst mistakes you can ever make at work

-

Health1 year ago

Health1 year agoBreaking down the Malaria Vaccine Rollout in Uganda

-

Entertainment1 year ago

Entertainment1 year agoIsaiah Misanvu Teams Up with Nil Empire for a Soul-Stirring Anthem of Gratitude and Transformation “Far Away”