Business

What Ugandans Need to Know About Green Financing

As of March 2025, they are drafting a policy to guide banks on financing projects.

As Uganda faces the impacts of climate change such as floods, droughts, and deforestation, green financing is emerging as a powerful tool for building a sustainable future. For everyday Ugandans, from farmers in Lamwo to business owners in Kampala, understanding green financing could mean access to new opportunities, improved livelihoods, and a healthier environment. Here’s what you need to know about this growing movement and how it is taking shape in Uganda.

Green financing refers to directing funds toward projects that protect the environment and combat climate change. This includes loans, investments, or funds for initiatives like solar power plants, energy-efficient buildings, and tree-planting projects. It is not just charity; it’s a way to make money work for both profit and the planet. In Uganda, this could involve financing cleaner cooking solutions or sustainable farming practices instead of activities like charcoal burning that harm forests.

The Bank of Uganda (BoU) is taking action. As of March 2025, they are drafting a policy to guide banks on financing projects. The main goal is to support eco-friendly ventures while making it more difficult for harmful ones to receive funding. For example, if you plan to borrow money to start a charcoal business, expect higher loan costs or stricter conditions. Why? Charcoal production contributes to deforestation and carbon emissions, exacerbating Uganda’s environmental crisis. Instead, the BoU aims for banks to back projects like renewable energy or agroforestry, consider solar panels for rural homes or coffee farms that also serve as carbon sinks.

This initiative is not entirely new. In 2024, the BoU collaborated with the Uganda Bankers Association to launch an ESG Framework which is short for Environmental, Social, and Governance. This framework serves as a roadmap for banks to prioritize sustainability, aligning with Uganda’s objectives for responsible growth. Green financing is a crucial aspect of this strategy.

For Ugandans, green financing is more than just policy, it has practical implications. If you are a farmer, it could provide access to cheaper loans for drip irrigation systems that conserve water. If you run a small business, energy-efficient upgrades could lower your utility bills and qualify you for better funding. Even households stand to benefit, imagine a green mortgage that rewards you for building a home with solar panels or good insulation.

Beyond individual benefits, the broader picture is crucial. Uganda is losing its forests rapidly being over 2% each year which contributes to climate instability. Green financing aims to reverse this trend, creating jobs in clean industries while improving air and water quality for everyone. Experts globally estimate that we need trillions of dollars to address climate change, and Uganda is part of that movement.

The BoU’s efforts may attract global investors. Countries like the UK are investing billions into green funds aimed at supporting Uganda, helping us build resilience against climate shocks. This presents an opportunity to leapfrog to cleaner technology, bypassing the dirty energy path that others have followed.

The transition to green financing will not be without challenges. Some concerns revolve around “greenwashing” where projects are marketed as environmentally friendly but fail to deliver real benefits. For instance, a solar company might promise significant savings but end up installing faulty panels, wasting money and eroding trust. Additionally, not every bank or business is prepared; some may resist change if it means short-term losses. For rural Ugandans, accessing these funds could be challenging if banks do not reach them or if the application process becomes overly complex.

There is also the issue of balance. Making charcoal loans more expensive could adversely impact small producers, especially those with limited alternatives. The BoU will need to pair this effort with support, such as training or funding for cleaner options, to avoid leaving vulnerable populations behind.

Green financing is part of a global shift known as ESG, which began decades ago when investors started avoiding harmful industries like tobacco. By the 2000s, it evolved into a system for assessing businesses based on their environmental impact, treatment of employees, and ethical leadership. Uganda is now catching up as climate pressures increase and global investments shift toward sustainability.

Keep an eye on the BoU’s policy, which is still in development as of March 2025. Inquire at your local bank about green loans or incentives for sustainable projects. If you are a community leader, advocate for awareness so rural areas are not overlooked. And if you are a student or entrepreneur, consider exploring green initiatives for there is a growing demand for innovators who can blend profit with purpose.

Green financing is not a magic solution, but it offers Uganda a chance to grow smarter. It is about investing in a future where the Rwenzori glaciers don’t vanish and where Lake Kyoga thrives.

Business

The Meta Trap: How One Bot Strike Can Liquidate Your Digital Career

As a digital communicator, this ban doesn’t just erase a social profile; it obliterates gigs and revenue streams.

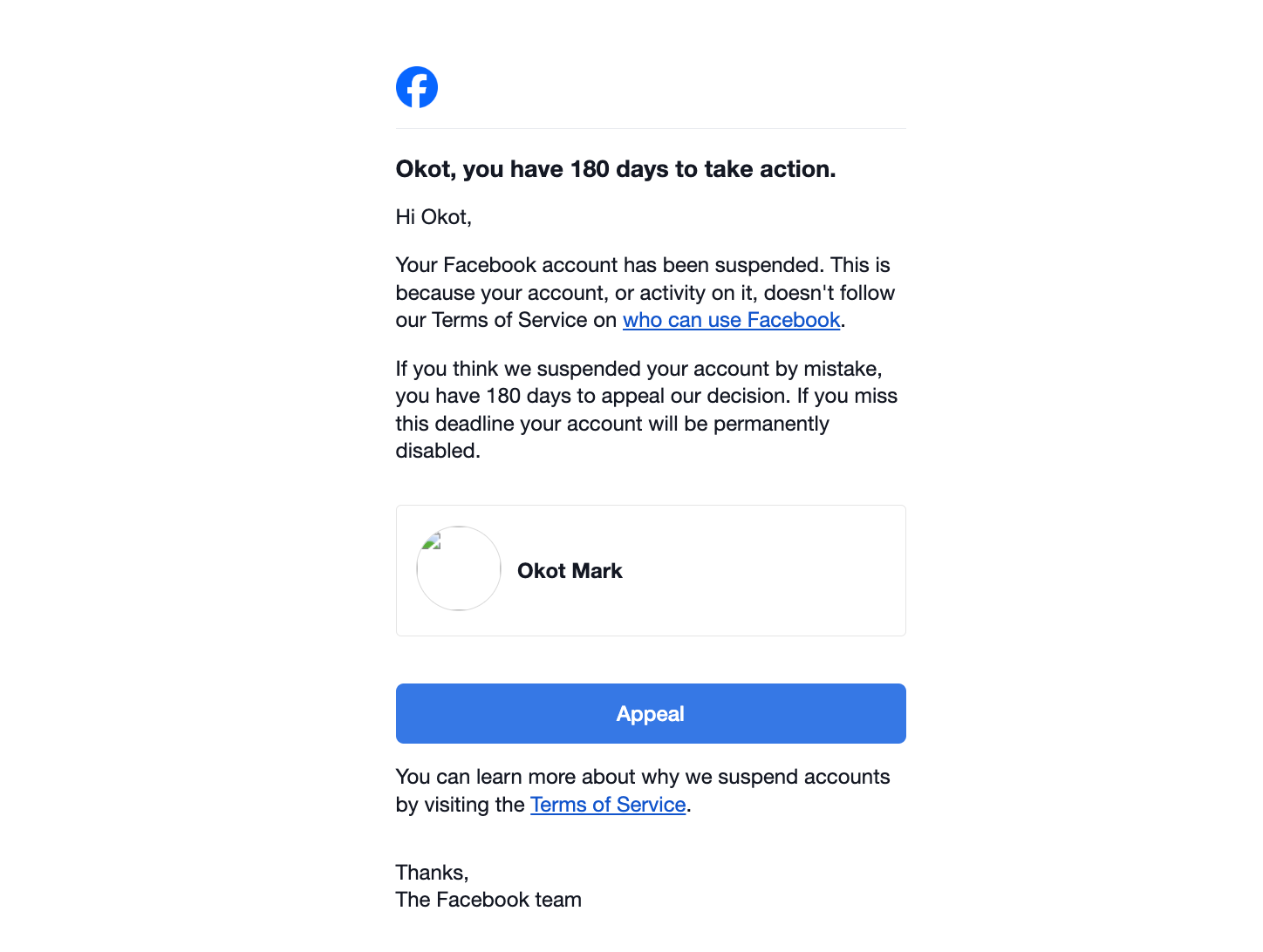

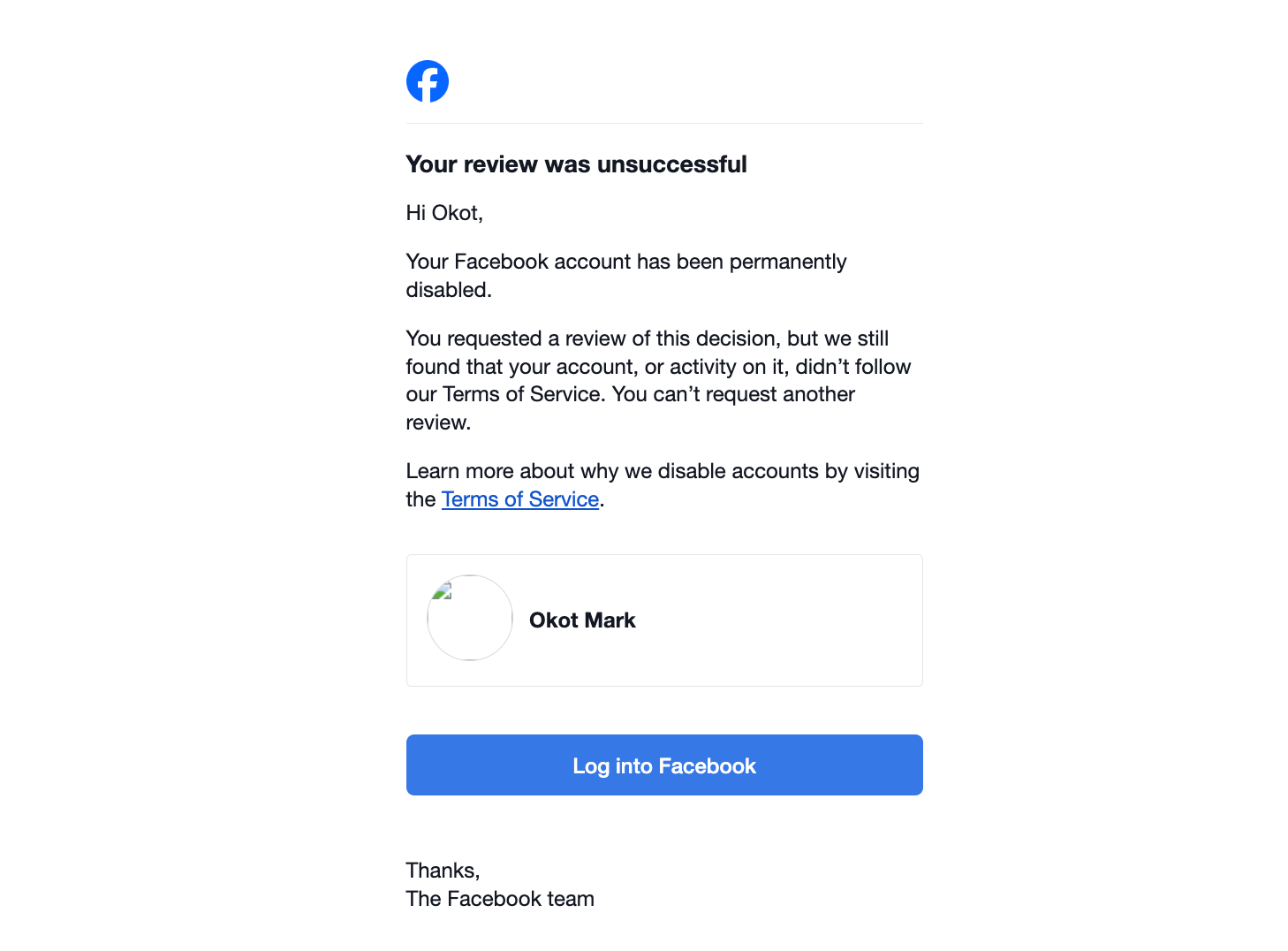

In the fast-paced world of digital communications and marketing, your online presence is your livelihood. For me, it was the foundation of multiple businesses: a music artist page, a clothing brand, a design company, and numerous client accounts. But on December 9th, everything changed with a single email from Meta. What started as a routine suspension notice escalated into a permanent ban overnight, stripping me of access to my entire professional ecosystem. No explanation. No recourse. Just gone. This isn’t just my story, it’s a cautionary tale for anyone relying on Meta’s platforms for their career.

I arrived home that evening to find an email from Meta notifying me that my Facebook account had been suspended. It urged me to appeal within 180 days, or face permanent deletion. Puzzled but proactive, I submitted my appeal immediately. By the next morning, another email arrived: my account was permanently disabled, and the appeal had been denied. No reasons were provided, just a cold statement that I’d lost access forever.

I rarely posted personal content on Facebook. My account was primarily a gateway to Meta Business Suite, the hub for managing professional pages across Facebook and Instagram. Through it, I controlled a suite of business assets: my own ventures and those of my clients. As the sole full admin, I handled everything from content scheduling to campaigns. Little did I know, this setup was a ticking time bomb.

When you create a page on Facebook or Instagram, linking them via Meta Business Suite creates a unified Business Portfolio. This is the command center for your digital empire. It allows you to manage pages, grant roles to team members, and integrate tools like WhatsApp Business Platform for large-scale operations. Third-party services often require access to this portfolio to function properly.

The problem? Meta’s system ties these portfolios tightly to personal accounts. When my account was banned, I was automatically removed as the full admin, leaving the role vacant. Suddenly, Meta held sole control over my pages and client portfolios. Attempts to log in via Instagram offered limited access, but I couldn’t remove the banned account or promote another user to full control.

Desperate for resolution, I reached out to Meta’s support; only to discover it’s virtually nonexistent for issues like this. Human responses (when they came) were unhelpful. Many online forums suggested subscribing to Meta Verified on Instagram as a workaround, but that didn’t resolve the core issue. I even filed countless “Admin Dispute Claims,” providing every requested document: business registrations, IDs, proof of ownership. Their response? They couldn’t manually promote another admin because the original account was banned. The exact reason I was disputing in the first place!

This circular logic is infuriating. Online communities are rife with similar complaints: Meta’s automated bots flag and delete accounts without transparency or appeal processes that actually work. Some advise assembling a legal team to confront Meta directly, arguing that they’re effectively holding your digital assets hostage. In my case, that’s exactly what happened. I lost control of my music page, clothing brand, design firm, and client accounts overnight, all without a single violation explained.

As a digital communicator, this ban doesn’t just erase a social profile; it obliterates gigs and revenue streams. Clients rely on seamless access to their ad data, analytics, and campaigns. Without it, projects stalled, trust eroded, and opportunities vanished. Researching further, I found this is a widespread epidemic. Countless marketers, creators, and small business owners have shared horror stories on forums like Reddit and X (formerly Twitter). Meta’s opaque algorithms and lack of accountability have led to lost livelihoods, with users begging for reasons that never come.

The stakes are high in an industry where platforms like Meta control the gates to billions of users. One unjust ban, and your life’s work evaporates. It’s not just about losing followers; it’s about Meta seizing ownership of your Business Portfolio and refusing to relinquish it.

If you’re in digital marketing or communications, don’t wait for the dreaded email. Here’s how to safeguard your assets:

- Distribute Admin Roles Wisely: Grant full admin rights in your Business Portfolio to a few trusted colleagues or partners. This creates redundancy, so a single ban doesn’t lock everyone out.

- Create Backups: Set up duplicate pages or alternative accounts as contingencies. Mirror key content and audiences where possible.

- Disassociate Personal and Business Accounts: Where feasible, unlink your personal Facebook account from business pages. Use dedicated business profiles to minimize risk.

- Diversify Platforms: Don’t put all your eggs in Meta’s basket. Build presence on alternatives like LinkedIn, TikTok, or X to mitigate total loss.

- Prepare for the Worst: Document everything, screenshots of access, business proofs and consider legal consultation early. It is said that Meta responds better to formal demands than support tickets.

Meta’s ecosystem is powerful, but it’s also precarious. One day, without warning, they could claim full ownership of your digital portfolio and refuse to give it back. My experience proves it. Don’t let it happen to you, act now to secure your future in this volatile online world.

Business

What Ugandan Artists on Bandcamp Need to Know

The US has introduced new tariffs following the expiration of the de minimis exemption, which previously allowed duty-free imports for shipments under $800

As a Ugandan artist on Bandcamp, you may have received a recent email regarding new US tariffs impacting global shipping. Announced on August 28, 2025, these changes affect the shipment of physical merchandise from Uganda to the United States, an important market for independent artists. This guide explains what the tariffs mean for you, how they may impact your sales, and steps you can take to continue reaching US fans.

The US has introduced new tariffs following the expiration of the de minimis exemption, which previously allowed duty-free imports for shipments under $800. This shift means many physical goods shipped from Uganda to the US now face import duties. Additionally, the uncertainty around these tariffs has led many global mail carriers to suspend deliveries to the US, creating challenges even for tariff-exempt items. Here’s how this affects you:

- Tariffs Hit Physical Merch, Not Digital Sales

Apparel and other goods like shirts, hoodies, hats, and totes are now subject to tariffs, which could increase costs for your US buyers. Digital sales; your MP3s, FLAC files, or streaming revenue are unaffected, offering a safe haven for part of your income. - Exemption for Music and Media

Good news: “informational media” like vinyl records, CDs, cassettes, books, and sheet music are exempt from these tariffs. However, many international carriers are halting all shipments to the US, even for exempt items, due to the tariff confusion. - Shipping Disruptions

With global carriers suspending US deliveries, even exempt items such as vinyl or CDs may not reach American fans at this time. These disruptions could delay orders, impact customer satisfaction, and affect your sales if not addressed proactively.

The US is a vital market for Ugandan artists on Bandcamp, where fans frequently purchase physical releases and merchandise. These tariffs and shipping suspensions may disrupt this important connection.

- Higher Costs for Fans

US buyers may face unexpected import duties on non-exempt items like apparel, making your merch less affordable. If you choose to cover these costs (via Delivered Duty Paid shipping), your profit margins could shrink. - Limited Local Options

Uganda’s manufacturing scene for high-quality vinyl or custom apparel is limited, meaning many artists rely on international suppliers or direct exports. Tariffs and shipping issues complicate this, potentially raising costs or delaying production. - Fan Trust at Risk

Unexpected fees or undelivered orders may cause confusion or dissatisfaction among US fans. Clear communication is essential to maintain audience loyalty, particularly in genres where Ugandan artists have established strong followings.

Bandcamp and industry insights offer several ways for Ugandan artists to navigate these changes:

- Pause US Merch Sales (If Needed)

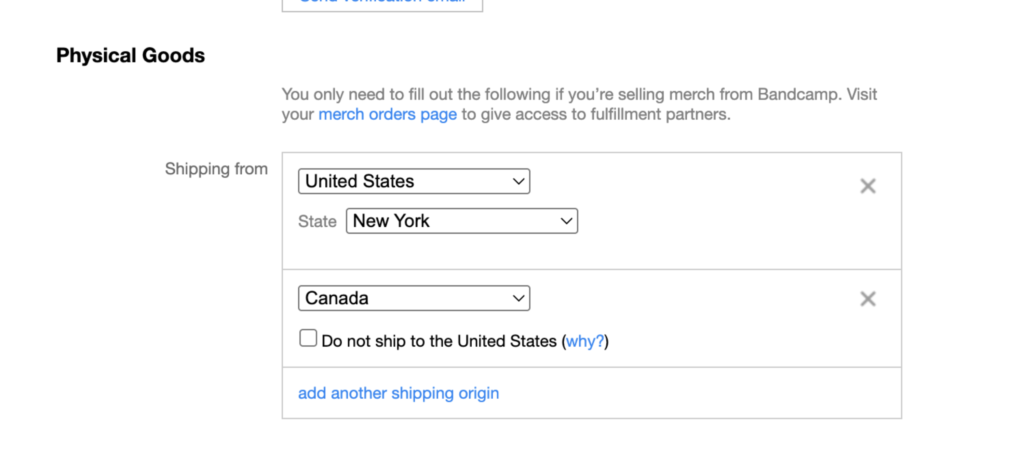

Bandcamp now lets you disable US shipping for physical goods from specific origins. Head to Edit Profile > Physical Goods > Shipping from in your account to temporarily pause sales. This can prevent headaches from undeliverable orders or unexpected fees while carriers sort out their US routes.

- Focus on Exempt Items

Prioritize selling tariff-exempt products like vinyl, CDs, or cassettes. Double-check with your postal carrier (e.g., Uganda Post or couriers like DHL) to see if they’re still shipping these to the US. Use accurate HS Codes on labels to ensure customs recognizes the exemption. - Talk to Your Fans

Use Bandcamp’s Community messaging feature to update US buyers about potential delays or tariff costs. Explain that these are government-imposed fees, not your doing, to keep fans supportive. A quick message can go a long way in preserving trust. - Consider Delivered Duty Paid (DDP) Shipping

For non-exempt items like apparel, DDP shipping lets you prepay tariffs and include them in the price, giving US fans cost certainty. This requires upfront calculations and may cut into profits, so weigh the pros and cons. - Lean into Digital Sales

Digital releases are tariff-free and immune to shipping woes. Promote your albums, singles, or virtual events to US fans to maintain revenue. For inspiration, look at how Ugandan artists like those on The Ugandan Rite use digital releases to reach global audiences. - Stay Updated

Check Bandcamp’s Help Center (https://get.bandcamp.help) for the latest on tariffs and shipping. Reach out to your postal carrier for updates on when US deliveries might resume. If you’re dealing with complex orders, consider consulting a trade expert for advice.

These tariffs and shipping disruptions could challenge Ugandan artists’ ability to reach US fans, a critical audience for Bandcamp sales. While digital sales offer a workaround, physical merch like vinyl or apparel is a big part of many artists’ income and cultural impact. In the long term, you might consider exploring regional markets in East Africa or pursuing digital collaborations to diversify your revenue, although these may not match the scale of the US market.

The new US tariffs are a hurdle, but Ugandan artists are no strangers to creativity and adaptability. By focusing on exempt items, pausing US shipping when needed, and keeping fans in the loop, you can minimize disruptions. Lean on Bandcamp’s tools and community to stay connected with your audience, and keep an eye on the Help Center for updates. Your music and merch are worth it; keep shining!

For more details, visit https://get.bandcamp.help or contact Bandcamp support.

Business

Uganda’s Kitgum-Kidepo Road Upgrade

Following the reintegration of the Uganda National Roads Authority (UNRA) into the MoWT in 2024, the ministry has taken full responsibility for delivering this vital project.

In a landmark decision, Uganda’s Parliament has authorized the government to secure a loan of €110.5 million (approximately Shs 450 billion) from Standard Chartered Bank. This funding will go towards upgrading the 115.8-kilometer Kitgum-Kidepo Road, a crucial infrastructure project that will connect the Kitgum and Kaabong districts in northern Uganda. The project aims to enhance tourism, improve regional connectivity, and address the socioeconomic challenges faced by the impoverished Karamoja subregion.

The Kitgum-Kidepo Road Project, led by the Ministry of Works and Transport (MoWT), involves rehabilitating an existing gravel road that extends from Kitgum town to the outskirts of Kidepo Valley National Park. Following the reintegration of the Uganda National Roads Authority (UNRA) into the MoWT in 2024, the ministry has taken full responsibility for delivering this vital project. The upgrade will transform the current Class C1 gravel road, which suffers from potholes, ruts, and poor drainage, into a high-quality, paved road. The project also includes widening the carriageway, improving drainage systems, and constructing two bridges to ensure year-round accessibility.

The road’s strategic location makes it crucial for unlocking agricultural productivity in Kitgum and Karenga districts, facilitating trade with South Sudan and Kenya, and promoting tourism by improving access to Kidepo Valley National Park, one of Uganda’s premier wildlife destinations.

On April 30, 2024, during a plenary session presided over by Speaker Anita Among, Hon. Henry Musasizi, the Minister of State for Finance, advocated for the loan’s approval. He emphasized the road’s importance in addressing the Karamoja subregion’s low road density, only 5.9 kilometers of paved roads per 1,000 square kilometers, and its potential to drive economic growth. “This road is critical for tourism and regional development,” he stated, pointing out that poor infrastructure has hindered Uganda’s ability to fully realize its tourism potential.

Despite broad support for the loan, the approval process faced scrutiny. Legislators, including the Leader of the Opposition, Hon. Joel Senyonyi, raised concerns about skipping a report from the House Committee on National Economy and the lack of transparency regarding the loan’s terms, such as interest rates and repayment schedules. Senyonyi warned about the risks of approving loans without thorough vetting, citing past problematic agreements. A motion by Government Chief Whip Hon. Denis Hamson Obua to waive the committee report requirement ultimately prevailed, reflecting Parliament’s commitment to addressing infrastructure deficits. The government has pledged that the loan will align with Uganda’s fiscal sustainability goals, with further details available through the Ministry of Finance.

An Environmental and Social Impact Assessment (ESIA) conducted in June 2024 ensures compliance with national and international standards, including the IFC’s Performance Standards and Equator Principles IV. The project will traverse open woodlands and semi-arid vegetation, avoiding critical habitats but will result in the loss of 14.4 hectares of natural habitat in the Nyangea-Napore Forest Reserve. Mitigation measures will address vegetation clearance, waste management, and dust emissions. The project will impact 59 culturally significant shea butter trees, which are valued for their spiritual, medicinal, and economic importance, as well as archaeological sites, including Iron Age pottery. Mitigation strategies include documentation, selective rerouting where feasible, and community consultations to preserve cultural heritage.

Socioeconomically, the project will benefit 158,549 individuals across the Kitgum and Karenga districts by improving access to markets, schools, and health facilities. Extensive stakeholder engagement, including focus groups with women, youth, and community leaders, has helped shape the project’s design. A grievance redress mechanism will ensure ongoing community feedback and conflict resolution. Challenges such as involuntary resettlement and gender-based violence will be mitigated through cash compensation, livelihood restoration initiatives, and community sensitization, with special attention given to vulnerable groups.

The upgraded Kitgum-Kidepo Road is poised to deliver transformative benefits, including:

- Tourism Boost: Improved access to Kidepo Valley National Park is expected to increase visitor numbers, supporting Uganda’s Vision 2040 goal of promoting tourism and potentially boosting regional tourism revenue.

- Economic Growth: Enhanced connectivity will facilitate domestic and cross-border trade, unlocking agricultural potential and creating hundreds of local jobs during construction, with further economic impact assessments underway.

- Social Impact: Year-round, safe passage will improve access to education, healthcare, and markets while reducing travel times. The upgrade will introduce speed bumps, signage, and pedestrian crossings to address current safety gaps, such as the low helmet usage (17%) among bodaboda cyclists and inadequate road markings.

- Environmental Benefits: A sealed road will reduce dust emissions, improving air quality and public health.

While the project holds immense promise, it faces challenges, including managing construction-related disruptions and ensuring equitable benefits. Mitigation measures include dust suppression, community sensitization on road safety, and adherence to a Resettlement Action Plan to support affected individuals. The road’s climate-resilient design, featuring elevated embankments, stormwater management, and a Climate Risk Monitoring Framework, will mitigate flood risks in a region with bimodal rainfall. The Ministry of Works and Transport (MoWT) will implement a robust monitoring framework to track environmental, social, and economic outcomes, with regular community feedback to ensure accountability.

The approval of the Kitgum-Kidepo Road upgrade marks a pivotal moment for Uganda’s northeastern region. By addressing infrastructure deficiencies, the project aligns with national development goals and sets the stage for economic and social transformation. As implementation progresses, stakeholders must ensure transparent execution and robust mitigation to maximize benefits for communities, businesses, and tourists. A map of the road’s route is available through the MoWT’s project documentation.

This historic investment in Uganda’s infrastructure underscores the government’s dedication to fostering inclusive growth and unlocking the potential of one of its most underserved regions. The Kitgum-Kidepo Road is not just a pathway; it is a gateway to a brighter future.

-

Entertainment11 months ago

Entertainment11 months agoMuseveni’s 2025 Copyright for Musicians breakdown

-

Business11 months ago

Business11 months agoUganda’s Ministry of Finance projects significant growth opportunities in 2025

-

Policies11 months ago

Policies11 months agoBreakdown of the Uganda Police Force Annual Crime Report 2024

-

Policies11 months ago

Policies11 months agoIs Uganda’s Shs10m Fine the WORST Thing for Cohabiting Couples?

-

Sports10 months ago

Sports10 months agoThe Transformative Impact of World Cup Qualification for Uganda

-

Health11 months ago

Health11 months agoBreaking down the Malaria Vaccine Rollout in Uganda

-

Business11 months ago

Business11 months agoThe 9 worst mistakes you can ever make at work

-

Entertainment11 months ago

Entertainment11 months agoIsaiah Misanvu Teams Up with Nil Empire for a Soul-Stirring Anthem of Gratitude and Transformation “Far Away”